The proliferation of online-to-offline services in China will continue to play a major role in the growth of the country’s e-commerce sector, global management consultancy McKinsey & Co. predicts in a new report. But O2O, as it’s called, is quickly evolving beyond its focus on discounts, deals and promotions.

In its recent iConsumer China survey, “How Savvy, Social Shoppers Are Transforming E-Commerce,” McKinsey outlines the ways in which consumers are coming to expect more from O2O. Where it had been a way for merchants to lure consumers into their bricks-and-mortar stores by offering reduced pricing via internet advertising, shoppers are now saying that the convenience and access to premium services that O2O provides are equally important.

For merchants, “offering new levels of value may be the keys to achieving mass-market acceptance and establishing business models that will thrive over the long term,” McKinsey researchers wrote.

McKinsey points to a few other well-established trends in China’s e-commerce sector in addition to O2O that will drive growth going forward, not least the rising consumption seen in smaller cities and the increasing propensity of shoppers to look overseas when buying goods. All of these sales channels hold “enormous potential,” the consultancy wrote.

China’s top internet companies have all invested heavily in O2O in order to capture market share in a surging but hypercompetitive space. E-commerce giant Alibaba Group last August paid $4.63 billion for a 20 percent stake in consumer electronics chain Suning and last month invested $1.25 billion in Shanghai-based food-delivery business Ele.me.

Intense competition is the main reason pricing and discounting has been the most common strategy for building market share and drawing customers away from rivals. “At this stage, discounts still drive industry because it hasn’t consolidated yet,” said Fang Gong, a Shanghai-based partner at McKinsey and co-author of the report.

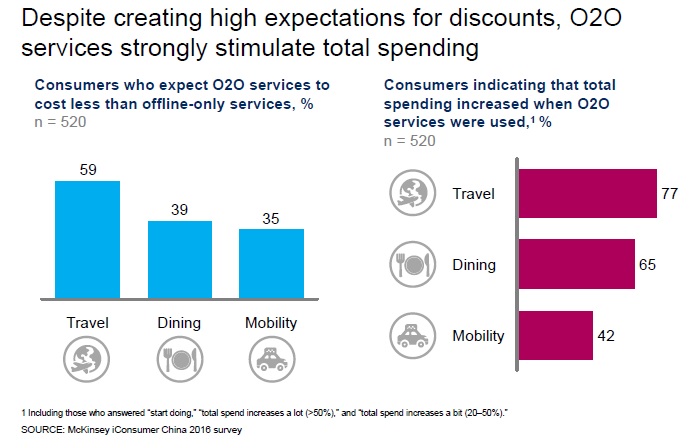

But O2O is maturing. While deals are still important, consumers have begun to increase their total spend after their first engagement with these services. This is especially true in the travel, dining and transportation sectors.

Data from McKinsey show that 77 percent of consumers boosted their outlay of cash on travel after first patronizing an O2O vendor. In the dining space, that number was 65 percent. For transportation, dominated by taxi-hailing services, 42 percent of consumers spent more after their first try using O2O.

“This suggests that O2O services offering a unique value proposition could power additional growth in China’s online market over the years to come,” according to the McKinsey survey. For example, in food services consumers said they are willing to spend more for faster delivery (52 percent) and better packaging (49 percent).

A reduced focus on price is particularly pronounced in taxi-hailing services. After months of cutthroat price competition among providers, fewer consumers–Just 35 percent of those surveyed by McKinsey–said they expect lower prices from O2O transportation services, compared with 59 percent who expect lower prices from O2O travel services.

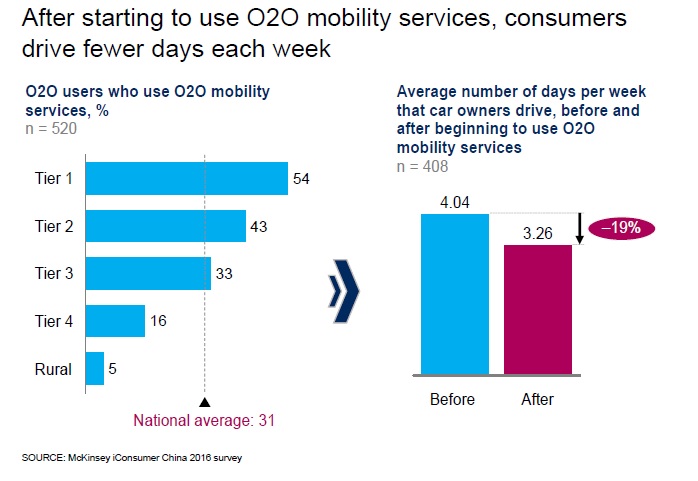

Researchers added that the advent of taxi-hailing apps has changed consumers’ driving behavior. “Survey respondents reported that the average number of days they drive per week dropped by nearly one full day,” down to 3.26 days a week from 4.04 days, McKinsey wrote.

Gong stressed that O2O providers will increasingly compete on innovation and expanded offerings as the industry shakes out. “I think in general every O2O [service] should move in that direction,” he said. “They’re just in different stages.”