Photo credit: Alibaba Group

Generation Z is the fastest-growing consumer cohort of imported goods in China, said an Alibaba executive on Wednesday.

The number of shoppers born after 2000 grew more than 70% on Alibaba cross-border marketplace Tmall Global in the 12 months ended March 2021. Of the 100 million annual active users on the platform, around 30% were born after 1995.

“Consumers of imported goods are getting much younger, with the fastest growth from Gen Z consumers, [so] their huge consumption potential is important to brands,” said Alvin Liu, president of Alibaba B2C Retail, at a virtual summit held on Wednesday for international brands.

The number of Zoomers on Tmall Global is nearly in lockstep with China’s national average. Defined globally as the generation born from 1995-1996 onwards, these young consumers accounted for more than 30% of the Middle Kingdom’s internet population in 2020.

As digital natives themselves, it is no surprise that Gen Z are leading the charge in China’s import market, the second-largest in the world for 11 years running and valued at over $2 trillion between Jan. to Nov. last year.

More pleasure-seeking and economically powerful, they are willing to pay a premium for quality goods and fresh experiences.

Reshaping the Consumer Market

The rise of Gen Z consumers has reshaped the consumer market and sales of perfume, whiskey and fashion products have all grown as a result, Lynn Dong, general manager of global business development at Alibaba Import said on Wednesday.

“The emerging Gen Z cohort values individuality higher, and they spend more on enjoying themselves,” she noted.

These evolving consumption habits are clear in the perfume industry, where young consumers use scents to express their mood, personality and even values. Zoomers are a driving force behind the growing popularity of niche perfume brands on the platform and spurn classic floral fragrances in favor of vanilla, chocolate and wood notes.

But not all Gen Z trends are wearable, and with analytics and insights, Tmall Global has been able to identify fresh consumption patterns, said general manager Anita Lv.

Young people with interest in wellness and self-care are turning health supplements into snacks, data shows, and the trend has given birth to new brands.

American health-supplement brand Codeage hit $100,000 in sales five months after its Tmall Global flagship launched in June 2021, and shifts more than 1,000 bottles of the company’s top-selling product collagen peptides a month.

Data tools, paired with insightful industry analysis are helping new brands like Codeage to identify potential customers and take off within a short period of time, said Melody Zhu, who is in charge of the brand’s business in China.

Global Cravings, Satisfied

Hunger for diversified imported goods is growing among Chinese consumers of all ages as they look beyond daily necessities to new product categories, from freeze-dried cat food to liquid baby formula.

“We are keen to incubate new categories, new SKUs and new brands to better serve consumers,” said Liu.

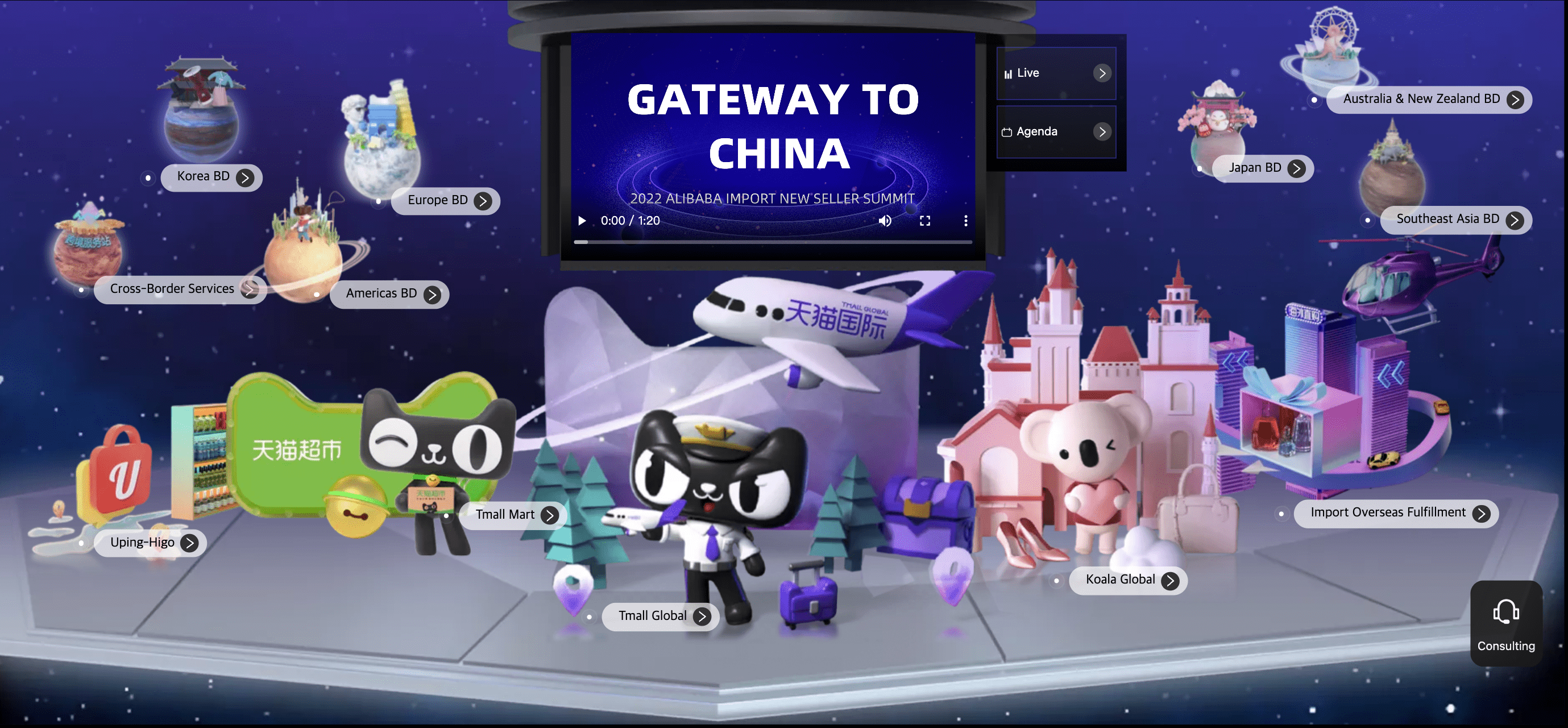

International brands can enter China several ways on Alibaba. If brands have identified an appetite in China for their products, they can open an online store on Tmall Global or Tmall Mart, the online supermarket, to sell directly to consumers.

Or they can join the membership-based platform Koala Global to reach high-value female consumers.

And for brands that aren’t ready to launch a flagship store, they can test products through Alibaba’s Import Overseas Fulfillment model and send the goods to Cainiao’s overseas bonded warehouses.

“These solutions will help international brands grow from cradle to adulthood until they come into full play in China,” said Dong.

Consumers can now choose from more than 35,000 brands across over 90 countries and regions on the platform.

Last year, more than 6,000 new brands entered China through Alibaba’s import ecosystem, an umbrella term used to describe Alibaba’s cross-border e-commerce platforms such as Tmall Global, Koala Global, Tmall Mart and Import Overseas Fulfillment.

And more than 2,000 brands were incubated within Alibaba Import have generated monthly sales of over RMB100,000 ($15,688), according to the company.