Since its 2014 initial public offering on the New York Stock Exchange, Alibaba has frequently been described by Western observers as “the Amazon of China.”

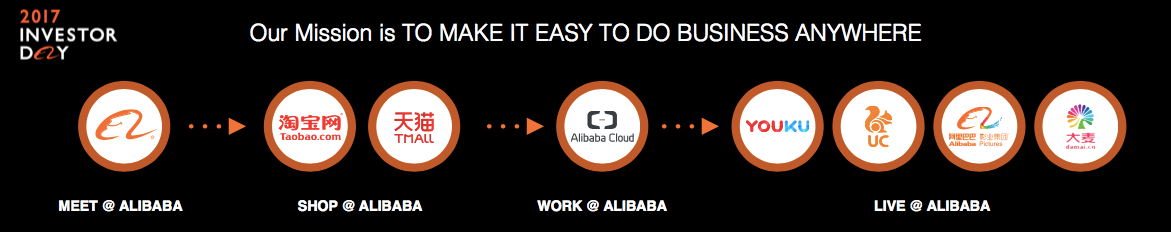

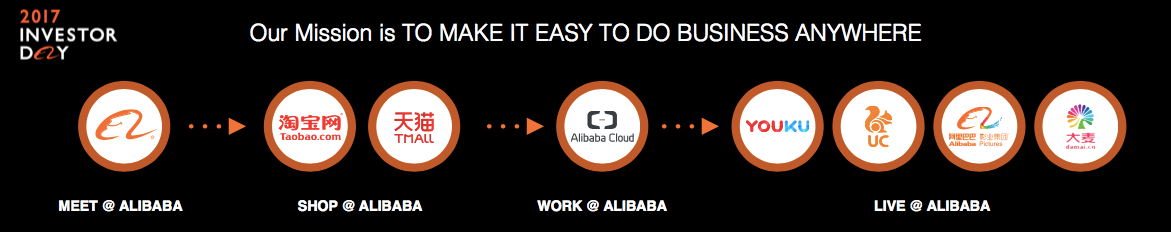

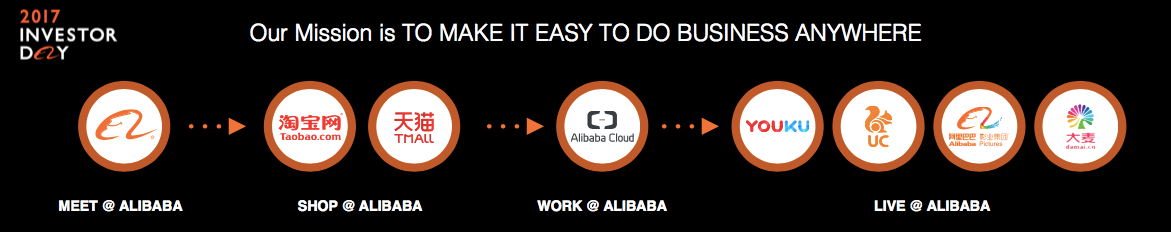

But at the company’s Investor Day last week, Alibaba executives got the message across that Alibaba has grown far beyond its e-commerce roots and should be viewed as a full-fledged technology company—one with a complex digital ecosystem of new, mature and interconnected businesses, as well as initiatives into cloud computing, artificial intelligence and other cutting-edge technologies.

As CEO Daniel Zhang told investors, the best way to understand the company is that Alibaba is an economy unto itself.

“We have so many customers, half a billion customers around us,” Zhang said. “We have close to 10 million small businesses working on our platform, transacting on our platform every day. We are now moving to new areas like digital entertainment. Together with all the partners, all the participants in the ecosystems—buyers, sellers, service providers, content providers—today, altogether, we constitute a real economy.”

That’s not an idle boast. In the company’s last fiscal year, Alibaba’s core commerce platforms generated nearly $550 billion in gross merchandise volume, of the total value of sales on its marketplaces. If GMV were GDP, that would make Alibaba the 22nd-largest economy globally, just behind Argentina, Alibaba Executive Jack Ma said in a closing address during Investor Day.

The company has its sights set much higher. Alibaba over the next 20 years hopes to create 100 million jobs, support 10 million profitable businesses and serve 2 billion consumers worldwide—which would, Ma said, make it akin to the world’s fifth-largest economy, behind only the U.S., China, Europe and Japan.

“If a company can serve 2 billion consumers, that is one-third of the total population of the world,” Ma said. “If a company can create 100 million jobs, that is probably bigger than most governments can do. If a company can support 10 million profitable businesses on its platform, this is called an economy,” he said.

Zhang emphasized that if you look at the components of this economy, “you see a very clear picture and very big synergy across each of the platforms, each of the business sections.”

“You can see that we start from the physical products,” Zhang said. “We start from China; we start from China wholesale and the retail platforms. Over time, we moved to cross-border exports and cross-border imports. Over time we moved to a new area, which is digital entertainment, because we want to give our consumers more chances to consume more products in more categories. Today, also by our investment in Koubei ‚Ķ (and) in other companies, we also get a chance to move to local services. We believe it’s very, very important for people’s daily lives.”

But just building new Alibaba businesses and revenue streams is not the goal, Zhang said. “The most important thing Alibaba is doing is to build the infrastructure for all the participants to do business easier in this economy.

“The first is our payment and financial services,” he said. “We provide these services through our affiliated company, Ant Finance. We also have our logistic services provided by another affiliated company, Cainaio. Via our Alibaba marketing platform, we provide our merchants, our sellers, our partners, a marketing platform not only to sell the product, but also to market their brand, to promote their brand, to manage their consumers. At the very bottom, which is the foundation, which is the physical infrastructure of all the economy, is cloud [computing].”

The fuel that makes it all run, he added, is big data. As a byproduct of platform activity, data is being used to drive new efficiencies and new innovations.

As Zhang put it, Alibaba strives “to get the real value from the data mining and the data analytics and the computing, then to use the value of this data to refuel the operation of the entire economy, to refuel the operation of our participants’ operations.”

Because of its sheer size and millions of users, Alibaba is benefitting from the network effect as more and more people become customers of its businesses.

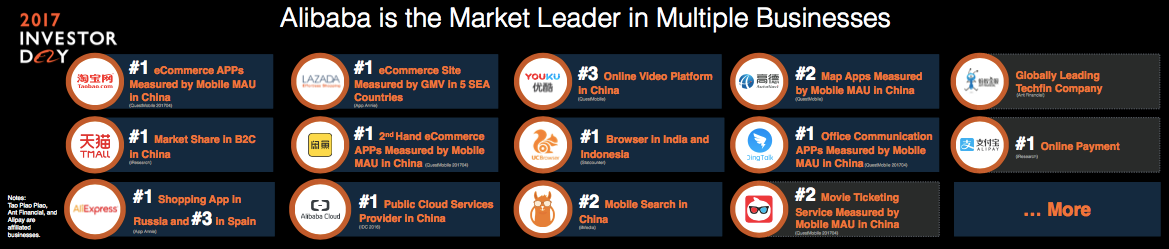

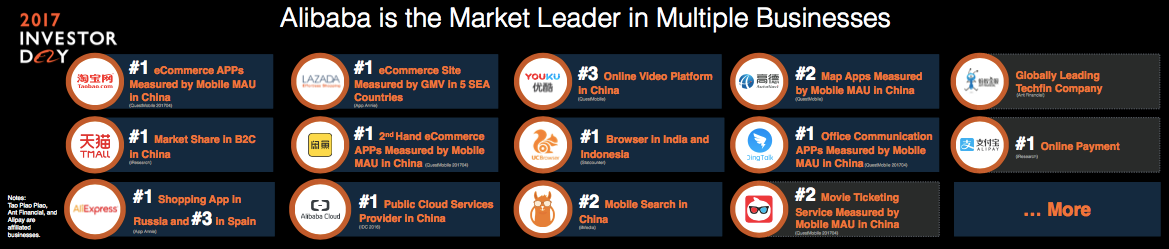

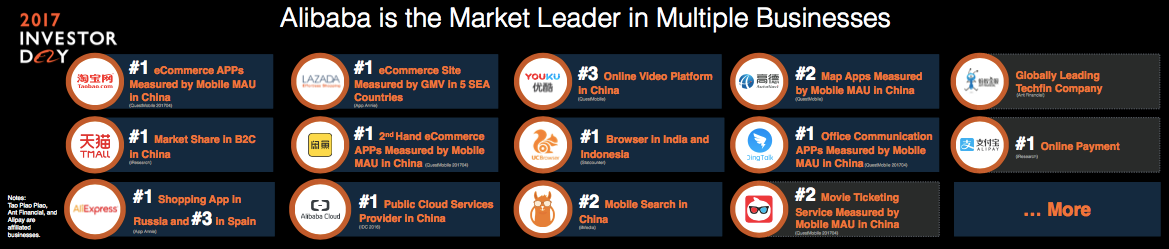

“People might not fully appreciate that we are the business leader not only for commerce or the cloud,” said Alibaba Group Chief Financial Officer Maggie Wu. “We are the business leader in so many areas.”

According to Wu, Alibaba is not only number one in e-commerce, with Taobao already the single largest mobile economy in the world. Tmall controls the most market share for business-to-consumer online retail in China. Thereare also AliExpress and Lazada, which are the top sites for e-commerce in Southeast Asian countries and Russia. AutoNavi is the second-ranked map app measured by monthly active users in China, while DingTalk is top among office communication apps.

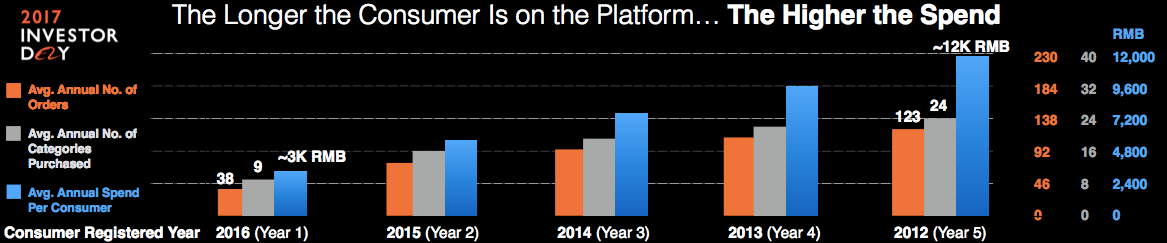

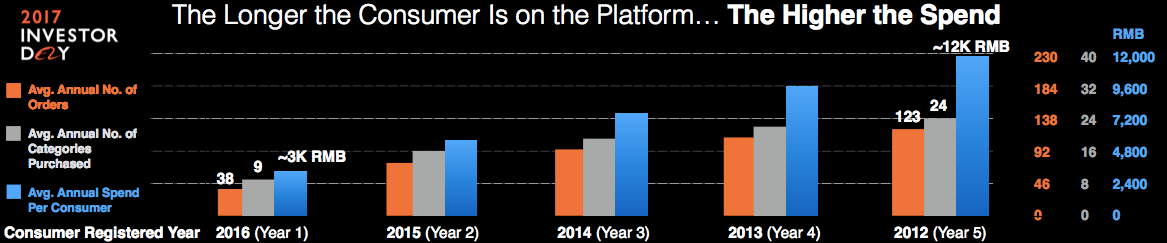

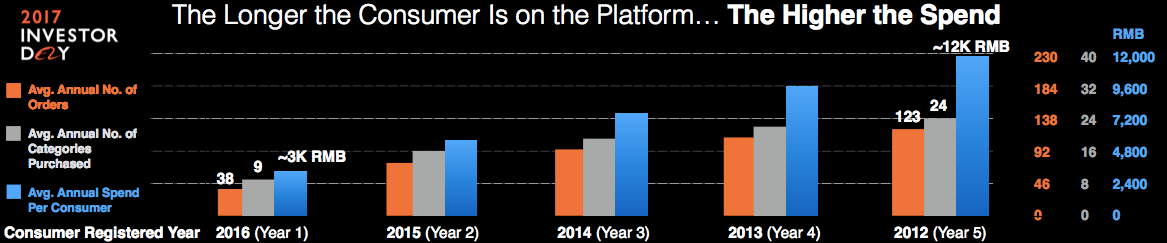

There’s also evidence that synergies mentioned by Zhang produce a positive feedback loop—evidenced by the fact that the longer consumers have been using Alibaba, the more orders they place, the more types of products they buy and the more they spend.

This is “important to understand the broader value proposition we are talking about because that explains not only [Alibaba’s] revenue growth but also the robustness and the potential of this business,” CFO Wu said.

And the potential of the Alibaba economy.