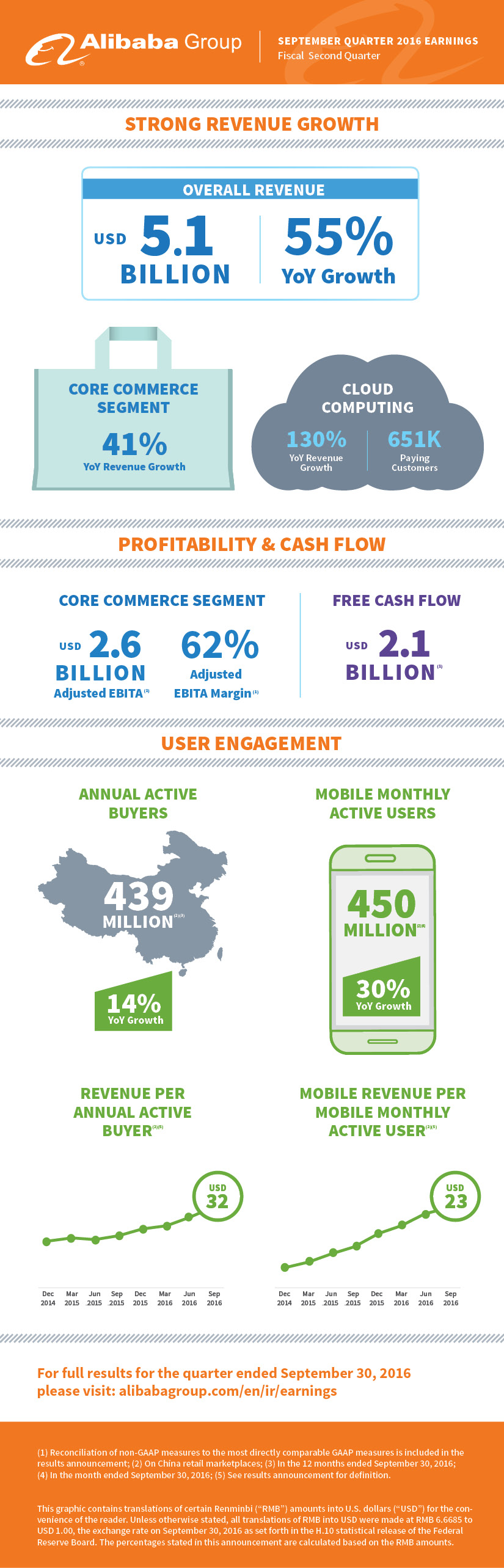

Alibaba Group today announcedfinancial results for its fiscalsecond quarter endedSept. 30, 2016. The highlights can be found below in an infographic and in a summary from the company. To read Alibaba Group’s press release covering the results in greater detail, click here.

Summary:

-

-

- We had a very strong quarter; strong beat top to bottom.

- We reported robust revenue growth of 55% this quarter with strong growth coming from each of our reporting segments.

-

-

- 41% revenue growth from Core Commerce; margins at 62%.

- Triple-digit revenue growth incloud computingand digital mediaand entertainment segments.

-

-

- Mobile continues to be the preferred way for customers to access Alibaba’s ecosystem; we are increasingly monetizing our 450 million mobile active users through new, innovative experiences.

-

Financial highlights:

-

-

- Strong beat on non-GAAP diluted EPS of US$0.79, which was up 46%.

- Total revenue growth of 55% to US$5.1 billion.

- Strong core commerce revenue growth of 41% YoY to US$4.3 billion.

- Triple-digit revenue growth in cloud computing and digital media andentertainment segments.

- Free cash flow of US $2.1 billion gives us strategic and operational flexibility to invest in future growth.

- Our Core Commerce segment is highly profitable, generating US$2.6 billion in adjusted EBITA and 62% adjusted EBITA margin.

-

Very Strong Performance of Core Commerce

User growth & engagement:

-

-

- Mobile MAUs on China retail marketplaces reached 450 million, up 30% YoY.

- Annual active buyers on China retail marketplaces reached 439 million, up 14% YoY.

- Continued year-over-year increase in the number of clicks and high social engagement.

-

-

- More than 6 million social shares per day on Taobao mobile app.

-

-

User monetization:

-

-

- Revenue per annual active buyer increased to US$32, up from US$30 in the prior quarter.

- Mobile revenue per mobile active user increased to US$23, up from US$21 in the prior quarter.

-

Mobile leadership:

-

-

- Mobile revenue increased 78% YoY, accounting for 78% of China commerce retail revenue, compared with 75% last quarter.

-

Rapid Growth of Cloud Computing

-

-

- Cloud computing revenue grew 130% YoY and segment-adjusted EBITA loss further narrowed to US $8 million; the business is approaching profitability.

- Paying customers grew to 651,000 from 577,000 in the previous quarter.

-

Growing Traction in Digital Media and Entertainment

-

-

- Revenue up 302% YoY primarily due to consolidation of Youku and increase in revenue from mobile services provided by UCWeb, such as search, news feeds and game publishing.

-