Generated by Qwen

This article has been updated to add opinions from Eddie Wu during Q&A session with analysts

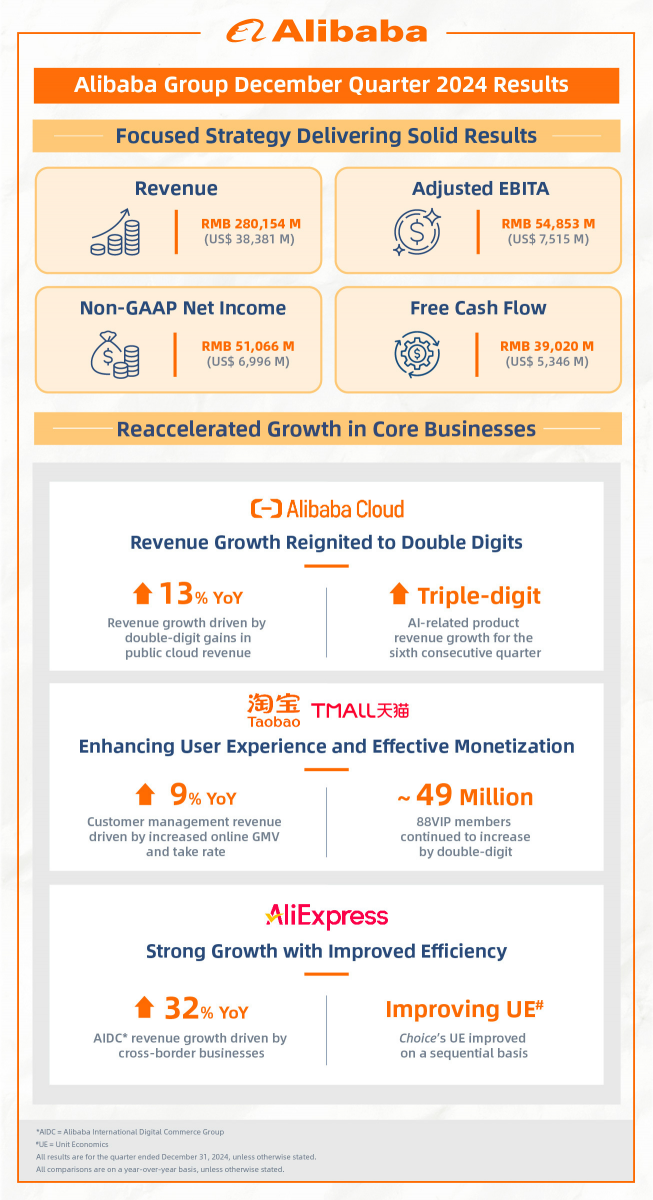

Alibaba Group delivered a strong December quarter, reaccelerating growth across its e-commerce and cloud businesses. The company’s strategic shift to a “user first” and “AI-driven” approach is paying off, as key segments outperformed expectations.

AI-Driven Growth Accelerates

Alibaba Cloud posted a 13% revenue increase to RMB 31.74 billion (US$4.35 billion), with AI-related products achieving triple-digit growth for the sixth consecutive quarter. The company’s focus on AI infrastructure solidifies its position as a key player in global cloud computing.

“Looking ahead, revenue growth at Cloud Intelligence Group driven by AI will continue to accelerate,” said Eddie Wu, Chief Executive Officer of Alibaba Group. “We will continue to execute against our strategic priorities in e-commerce and cloud computing, including further investment to drive long-term growth.”

Alibaba is at the forefront of AI innovation, with its open-source strategy fostering widespread adoption of its large-scale AI models. The Qwen family of models is the most popular open-source model among global developers, with more than 90,000 derivative models created since it was first released in August 2023. The company’s latest proprietary large language model, Qwen2.5-Max, earned a #7 ranking globally on the Chatbot Arena leaderboard through its outstanding performance. Chatbot Arena is a well-recognized open platform that evaluates the world’s best LLM and AI chatbots.

The profitability of the cloud business continued to improve, with adjusted EBITA climbing 33% year-over-year. This was driven by improvements in optimized product mix towards higher-margin public cloud and AI-related products and operating efficiency.

If AGI is achieved, the AI-relevant industry will very likely become the world’s largest industry

During Alibaba’s earnings call, Eddie Wu underscored the company’s long-term vision, framing artificial general intelligence (AGI) as its “primary objective” and emphasizing its transformative potential. “If AGI is achieved, the AI-relevant industry will very likely become the world’s largest industry,” Eddie Wu stated, positioning Alibaba’s investments in AI and cloud infrastructure as critical to capturing this future.

Eddie Wu likened AI to “the electricity of the future” and cloud computing to the “electricity grid,” signaling Alibaba’s ambition to dominate both the foundational technology and its distribution channels. While the company reported solid growth in its cloud division this quarter, Wu’s remarks highlighted a strategic pivot: rather than chasing short-term gains, Alibaba is doubling down on infrastructure and R&D to cement its role as a backbone of the AI-driven economy.

Taobao and Tmall Monetization Improves

Taobao and Tmall Group saw a steady 9% increase in customer management revenue to RMB 100.79 billion (US$13.81 billion), driven by improved online GMV growth and effective monetization. The business benefited from adopting the software service fee and increased merchant embrace of Quanzhantui, an AI-powered marketing solution especially valuable to small and medium-sized businesses for enhancing marketing efficiency.

88VIP, Alibaba’s premium membership program, continued to gain traction and its members increased double-digit year-over-year, reaching 49 million. The program’s influence was evident during the 2024 11.11 Shopping Festival, where 88VIP increased their spending by over 50% compared to the previous year. The 11.11 Shopping Festival itself saw record-high merchant participation and consumer engagement.

International Commerce Gains Momentum

Alibaba International Digital Commerce Group (“AIDC”) reported a robust 32% revenue increase, reaching RMB37.76 billion (US$5.17 billion). Cross-border e-commerce was a key driver, with AliExpress and Trendyol leading the 36% year-over-year increase in international commerce retail revenue.

AliExpress strengthened its market position through a joint venture with Shinsegae in South Korea, enhancing its product offerings and competitiveness in the market.

Meanwhile, Cainiao continued expanding its global smart logistics networks and optimizing its end-to-end logistics capabilities for Alibaba’s e-commerce businesses.

Returning Value to Shareholders

Alibaba’s quarterly revenue rose 8% year-over-year to RMB280.15 billion (US$38.38 billion), reflecting solid execution of its strategic direction in core businesses.

As part of its capital management strategy, Alibaba actively divested non-core assets, including disposing of Sun Art and Intime, for up to approximately US$2.6 billion. The company also repurchased US$1.3 billion worth of ordinary shares in the quarter, representing a net reduction of total shares outstanding by 5% fiscal year to date.

In November, the company successfully raised approximately US$5 billion through a dual-currency bond issuance, further strengthening its balance sheet and extending debt maturities at favorable rates.

This article has been updated to add details from Q&A sessions with analysts.