Photo credit: Alibaba Group

Tech giant Apple stepped up its campaign in China during a major Chinese shopping festival this month, hosting a livestream and offering rare discounts on its iPhone 14 Pro and Apple Watch Series 8.

Apple product experts offered tips on making movies or using your Apple Watch as a workout aide during the livestream, its first on an e-commerce platform. The broadcast garnered 300,000 likes and 1.3 million viewers within an hour.

Content was key for a host of retailers during this mid-year shopping festival, dubbed 6.18. Brands from Italian luxury fashion house Prada to French maison Balenciaga also put on the razzle-dazzle to attract shoppers as China emerged from its post-COVID slump. Superstar Argentinian footballer Lionel Messi even put in a guest appearance, sending fans scrambling for the T-shirt and sneakers he wore.

6.18 is China’s second-largest shopping festival after Single’s Day in November and the country’s first major retail event after the pandemic. Analysts have closely tracked participation for signs that consumption is picking up in the world’s second-largest economy.

For China’s largest e-commerce platform, Alibaba’s Taobao and Tmall Group, 6.18 was also an early test of its aggressive new strategy to attract users with “historic” levels of investment to defend its leadership in the world’s largest e-commerce market.

In a three-pronged attack, it vowed to unleash a stream of content, support for merchants and influencers, and harness the potential of artificial intelligence to make e-commerce more efficient and entertaining. Boosting gross merchandise value (GMV) and monetization was less of a concern than bolstering its ecosystem ahead of the economy revving up.

Within China, e-commerce players’ discounts are already starting to stimulate consumer demand said sector analysts, while merchant support measures expanded the supply of products. Alibaba kicked off 6.18 pre-sales on May 26, with a shopping window open between May 31 and June 3 and another between June 15 and June 20.

Given its heft, Taobao and Tmall’s push will likely lead to radical change in China’s retail market and beyond. Retail innovation in China has long been a source of inspiration for brands and merchants worldwide looking to modernize marketing and operations. Online sales have reached about a quarter of total retail sales in China, far higher than elsewhere.

So far, the campaign is working. As 6.18 drew to a close, Taobao and Tmall said a record number of merchants had participated in the festival while merchants’ GMV generally rose two to three-fold year-over-year.

Overall GMV for 6.18 rose 14.8% to RMB798.7 billion ($111.35 billion), according to third-party data provider Syntun and broker CMB International.

6.18 Content Creation

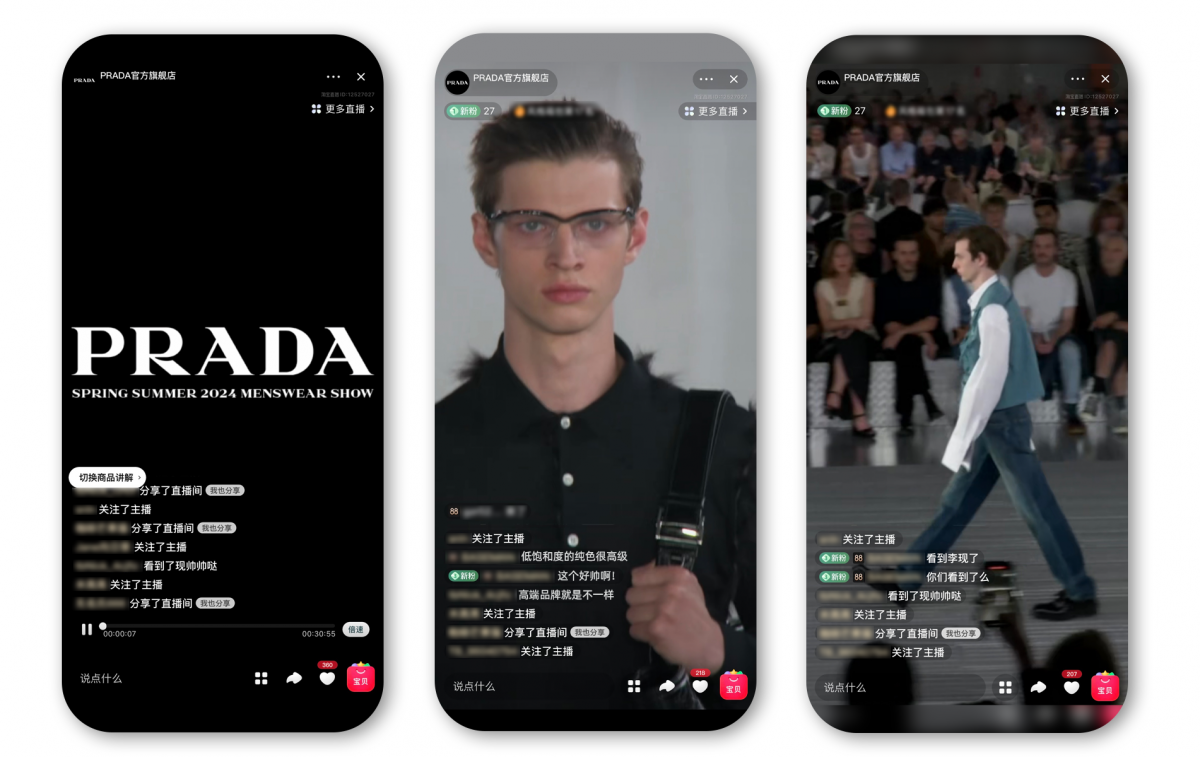

While the fashion world’s glitterati scrambled for a front-row seat at Prada’s catwalk in Milan on June 18, China’s luxury aficionados watched from the comfort of their homes. The Italian fashion house broadcast its 2024 spring and summer men’s fashion show live on the business-to-consumer branch of Taobao called Tmall.

6.18 threw into sharp relief the shift in how Chinese consumers shop, with increasing numbers looking for a side dish of entertainment on livestreams and videos.

“Beyond shopping, consumers want to find a broader range of more diverse content on Taobao, including shopping-related encyclopedic knowledge, lifestyle recommendations, and even interactive entertainment,” said Trudy Dai, the Director and CEO of Taobao and Tmall earlier this year.

Statistics from 6.18, from various angles, showed that content creation flourished during the festival. The number of influencers releasing short videos daily jumped 200% year-over-year, while average daily views on the consumer-to-consumer marketplace Taobao surged 113% year-over-year.

During 6.18, the number of livestreams on Alibaba’s dedicated livestreaming channel, Taobao Live, generating over RMB10 million in sales, hit 490, up 66% year-on-year.

Not all of the influencers were intent on selling during 6.18, many were focused on product education such as Apple, or building their profiles. Among the content creators joining Taobao Live so far this year, roughly a quarter of them are purely content livestreamers with no product promotion.

Merchants took greater control over their brand stories, with 55% more of them regularly releasing videos during the festival than last year. French fashion house Balenciaga livestreamed models walking the street outside of its maison in Paris to its 1.53 million fans on the Chinese site.

Alibaba’s luxury shopping platform Tmall Luxury Pavilion said over 40 luxury brand stores simultaneously started livestreaming their sales at the start of 6.18, 80% up on last year. The luxury platform also noted that jewelry sales made via livestream were 10 times higher than during the first four hours of last year’s festival, while the home decor sales were six times higher.

Generative AI

Who will be left behind as consumption picks up? A content-driven business model could be costlier than a traditional search-based e-commerce model, given the price of production and bandwidth consumed. For smaller merchants and content creators, the cost could be prohibitive.

That’s where Taobao and Tmall’s second arrow could hit home. The platform is harnessing technological advances from across the Alibaba ecosystem, such as its large language model, dubbed “Tongyi Qianwen” or “truth from a thousand questions”.

“AI-generated content will have significant impacts across our sector over time. The technology should increase the efficiency of content generation and improve the precision of content distribution. For example, AI can improve algorithms advertising and e-commerce companies use to target consumers,” said UBS analysts in a report.

AI could also drastically reduce the four or five months it takes for brands to launch on Taobao or Tmall with upwards of 120 people involved, according to one estimate.

AI could shrink that timeframe to as little as five hours and the people processing the application to ten. For brands, a shorter route to market would be liberating and allow them to execute their strategy faster.

The potential applications of AI for enhancing consumers’ experience on the platform are also startling. Every day, there are 100 million consumer queries about a product or service on the Alibaba platform. AI could provide richer, more nuanced and speedier answers.

While generative AI is still an emerging technology, Taobao and Tmall are offering other kinds of support, such as a greater flow of traffic to low-price goods offered by small and medium-sized enterprises. The GMV of over 2.56 million SMEs topped last year’s festival. Also, 1.18 million SMEs’ GMV surpassed RMB10,000 each.

Taobao app’s refreshed homepage showcased Alibaba’s priorities this 6.18, a prominently featured livestreaming portal and a value-for-money section.

For more 6.18 updates click here