As Alibaba’s 11.11 Global Shopping Festival grew into the world’s largest one-day, online sale, the annual event also became an opportunity for merchants all over the world to reach China’s consumers. Even within this much sought-after demographic, however, there is one group that deserves extra attention, especially as 11.11 approaches: millennials.

The group, defined as those born in the 1980s and ’90s, accounts for 58 percent of all internet users in a country with the world’s biggest e-commerce market at $672 billion in 2015, according to management consultancy McKinsey & Co.

Merchants are acutely aware of the group’s spending power: “A good percentage of our customer is post-80s and post-90s,” said Andrea Mantovani, head of digital and e-commerce at Moleskine China.

So in order to succeed on 11.11, Moleskine, as well as Unilever, Burberry, Maserati and the tens of thousands of other merchants who sell on Alibaba’s e-commerce platforms, must understand these twentysomethings and thirtysomethings and how to reach them.

Who Are China’s Millennials?

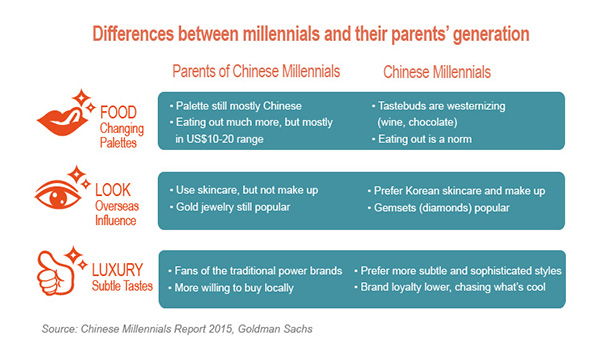

Chinese millennials grew up enjoying the benefits of the country’s economic reforms and the boom that followed, which gave them a much different attitude toward consumption than the generations that came before.

“Young people in China born in the 1980s and 1990s grew up in a completely different world than the one their parents came of age in,” says Eric Fish, author of the book The Want Generation. “Many have no memory or personal connection to the extreme economic and social hardship their parents endured.”

That’s why, according to a 2016 study from Boston Consulting Group (BCG), China’s millennials are “more motivated to spend.” In fact, their spending is on average 40 percent higher compared to other age groups in a range of product categories, including casual wear, smartphones and snacks.

For Tan Zhiyuan, a 21-year old university student in Beijing, this year’s 11.11 spend is already mapped out. At the top of his wish list? A winter jacket from NorthFace. Priced at $150, it will cost him nearly half of his monthly allowance, but that is a sacrifice he is willing to make.

“It’s important to have my own fashion style,” he says. “Even if it means I will eat snacks for lunch for the rest of the month.”

But while the amount spent may be higher for this group, purchase decisions are much more discerning than those of older consumers in China, according to Fish. Conspicuous consumption is much less important to millennials.

Also, Fish says that counter to the stereotype of the younger generation being more materialistic, Chinese millennials are in fact becoming less money-focused and more interested in things that represent them as individuals.

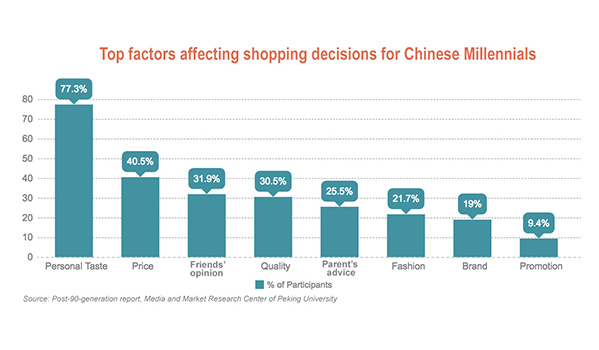

This expression of individuality is key. Research from Chinese investment bank CITIC Securities finds that while millennials make their purchasing decisions according to a broad range of factors, “fits personal taste” is by far the most important.

A Global Outlook

The fact that Chinese millennials are better educated than previous generations and have a more global outlook means they also have a stronger preference for overseas brands. However, this preference is more about factors such as trust, safety and reliability and less about social status.

Weiwei Shan, a 29-year-old senior human resources manager and mom-to-be based in Jiangsu Province, has a mission for this year’s 11.11: to purchase quality baby-care products. That includes everything from diapers to breast pumps, and, like many of her peers, trust is a key factor.

“I feel it’s safer to choose an overseas brand, or at least brands from joint venture firms,” she says.

But millennials aren’t just buying products. Their global outlook includes personalized services and experiences, as well, not least travel. According to a Bank of America Merrill Lynch report released earlier this year, 35 percent of Chinese outbound tourists by 2019 will be made up of people aged 25-34, the largest segment.

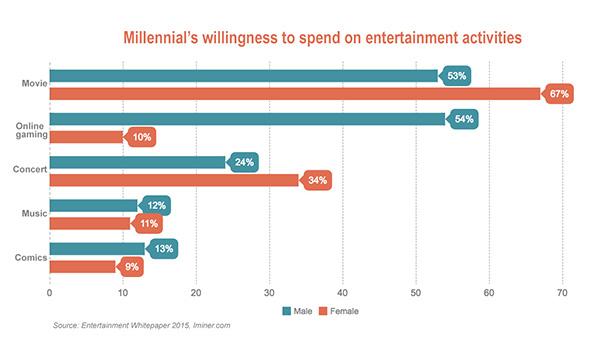

Entertainment, too, accounts for a large portion of consumption for millennials, with online gaming and movies among the most popular. A recent survey from marketing research firm Iminer found that up to 60 percent of respondents were willing to pay to watch a movie online, while over 54 percent of male respondents would pay for online gaming.

Winning on 11.11

Given the purchasing power of China’s millennials, how can a brand grab their attention and rise above the competition? Moleskin’s Andrea Mantovani shares three must-do strategies:

Mobile Content Is Key:

Innovative content viewable across mobile devices is key for any marketing campaign when reaching out to millennials, according to Mantovani. A simple tactical move for Moleskin has been to produce vertical videos, which have a better viewing experience on mobile. “Millennials in China prefer watching videos on mobile and a lot of them will navigate away if they need to rotate the device to watch the video in horizontal mode,” he said.”They want to watch it vertical.”

Speak Their Language, But Stay True to Your Brand:

Merchants need to know what makes millennials tick. That means keeping current with the latest trends and speaking a language that millennials can understand. However, Mantovani says that merchants should not stray too far from their core brand. That message needs to be “strong and clear,” he said.

Be Flexible and Move Fast:

Just as trends come and go quickly in the internet age, so, too, do platforms. So marketers should be nimble enough to switch from one to another as needed. “You want to get to [millennials] at a certain time, no matter where they are,” added Mantovani.