China is on track to become the most important consumer market in the world. According to eMarketer, the world’s second-largest economy will surpass the U.S. as the world’s largest retail market in 2021. For a deeper look at this critical market for brands across the globe, I sat down with Danielle Bailey, the managing vice president in Asia Pacific for research firm Gartner L2, who shared insights about how China is shaping the future of retail ahead of the 2019 11.11 Global Shopping Festival.

How is China’s retail landscape different from the U.S.?

There are several key differences between the China and U.S. retail landscapes, but I’ll focus on three key areas. Number one, China is mobile-first. Mobile payments have fueled the e-commerce revolution in China. At 86% mobile-payment penetration, the country is virtually cashless. Mobile payments facilitate both online and offline commerce, provide access and purchasing power to the unbanked and have transformed consumer engagement across the board.

While in the West, brands and retailers go it alone in building individual omnichannel strategies, in China, tech titans are driving omnichannel innovations and scaling them across multiple brands and retailers, hastening consumer adoption. What can never be understated is the pace of innovation and change in China – China Speed – in comparison to other markets. Every week a new platform is launching that promises to completely change the foundation of the ecosystem. Brands are forced to place bets and constantly reprioritize investments to keep up with the rapidly changing environment and rapidly changing Chinese consumer.

You talked about Western companies following China’s innovations. Are there examples that come to mind?

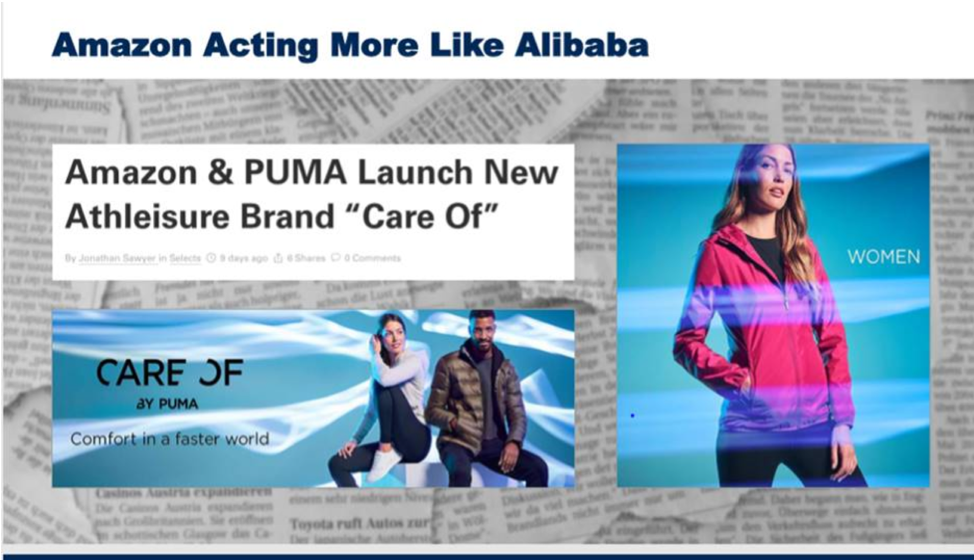

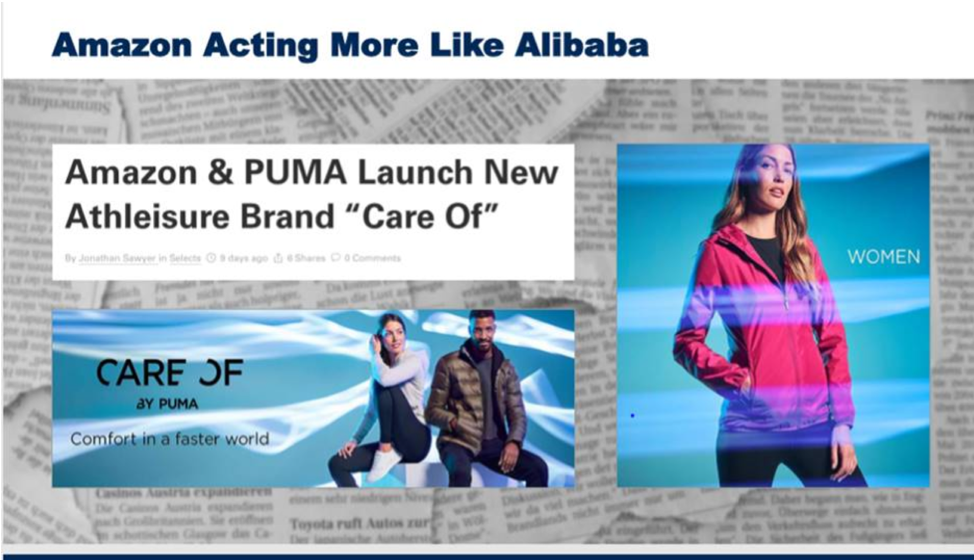

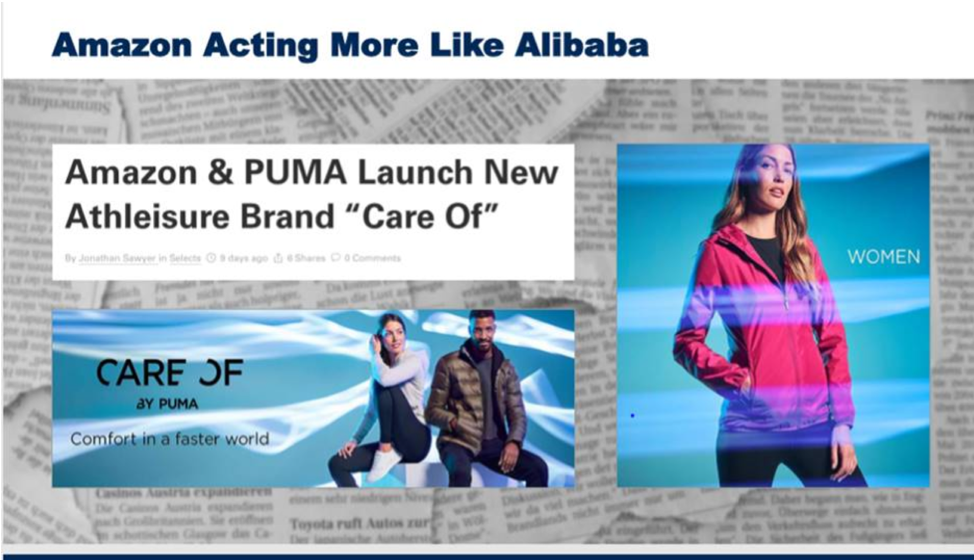

Most interesting, I think, are the recent moves that Amazon has been making less conspicuously. They clearly suggest that Amazon is mirroring many of Alibaba’s consumer and brand engagement tactics.

At Gartner L2, we often talk about Alibaba’s Tmall and Taobao as content and entertainment destinations as much as e-commerce destinations. Livestreaming has become a significant engagement and sales driver for both platforms and central to this year’s 11.11 Global Shopping Festival. Earlier this year, Amazon Live was launched. While it more resembles QVC or HSN than the dynamic, highly interactive livestreams that are China’s hallmark, Amazon is attempting to replicate Alibaba’s success. Amazon also hosted its first ever Prime Day concert and the Savage X Fenty Show this year, a clear acknowledgement of the power of “retail-tainment” that Alibaba has understood for years, exemplified by its annual 11.11 Countdown Gala and “See Now, Buy Now” fashion shows.

Unlike Alibaba who collaborates with brands and share consumers insights for them to develop better products, Amazon competes with brands. A recent co-launch of the Care Of athleisure brand with Puma, may suggest Amazon is looking to move from brand enemy to enabler, a role that Alibaba has relished and formalized through the Tmall Innovation Center.

How should retailers and brands embrace 11.11?

Retailers and brands should both embrace 11.11, not only as a key sales period but also as the opportunity to demonstrate and scale customer experience, product and loyalty innovations that last well beyond the single day.

What are you anticipating for this 11.11 in the context of New Retail evolution. What are you most excited about?

In the West, people are very focused on “buy online, pick up in store” and maybe some in-store digital screens to signal omnichannel innovation. The New Retail concept is much more comprehensive and transformative. It’s not just cosmetic but also extends to the development of new products, the elevation of in-store and customer experiences and the rethinking of the supply chain to garner efficiencies, customer loyalty and boost sales. International brands and retailers should adopt a New Retail mindset and think about how they can innovate at every consumer touchpoint.

The 2017 edition of 11.11 marked the extension of the world’s largest online holiday to the offline space. Beyond sales, augmented reality and mobile gaming were used as traffic drivers offline. I am curious to see what new incentives and digital innovations will be utilized to spur foot traffic in stores and transform the in-store experience.

Thus far, New Retail efforts have been concentrated in top-tier cities like Shanghai and Beijing.We’ve already seen the small format Freshippo stores. In the face ofthesuburbanization of China and persistenceof a substantial rural population,it will be interesting to see whatnew store formats, new delivery mechanisms, new products and packaging and access to e-commerce emerges.

Alibaba has been central to revolutionizing restaurant, grocery and hotel experiences in China. I look forward to seeing what segment of the retail industry they will transform next.

Are there any stores in China that represent the future of retail? How does that compare to store experiences in the U.S.?

Alibaba’s Freshippo stores obviously represent the gold standard of future retail concepts, combining artificial intelligence-driven merchandising, a mobile-enabled purchase and payment experience, the store-as-warehouse concept, robots and one of the country’s best dining experiences all under one roof. Competitors including JD.com, Tencent, and Suning all offer their own take on grocery innovation, but they are all still chasing the Freshippo model’s continual evolution.

The MAC Experience Store in Shanghai exemplifies the future of the digitally enabled in-store experience. The store’s focus is interactivity and product customization via augmented reality, virtual try-on and touch-screen technology and 3-D printing. Other beauty brands including Innisfree, SK-II and YSL Beauty also operate smart stores in China.

Other interesting examples online are Xiaohongshu, Douyin (China’s version of TikTok, also owned by Bytedance) and Tmall livestreaming, all of which directly connect social engagement to commerce, a nut that social platforms in the West still struggle to crack.

From visual merchandising to digital enablement, store experiences in the U.S. don’t compare. I’ve often said that the only thing that Amazon did to transform the Whole Foods experience post-acquisition is to hang up Prime signs everywhere. While Wal-Mart has worked hard to build a strong connection between online and offline with their “Pickup” program, little within the four walls has changed.

You have mentioned China as a testbed for innovation. Which international brands have successfully used China to test innovation? What are the lessons learned?

Many retailers including Starbucks and Nike have used China as an incubator for new, digitally enabled store formats, such as the Starbucks Roastery and Nike’s House of Innovation, both in Shanghai, that have since washed up on U.S. shores. Starbucks has moved to quickly bring concepts including delivery, pickup-only stores and livestreaming to the U.S. after first launching in China. While many of the merchandising elements in the New York City-based Nike House of Innovation are replicas of the Shanghai store, importing New Retail philosophies isn’t necessarily cut-and-paste and should be modified for market capabilities and consumer preferences. While Starbucks leverages Alibaba’s Ele.me delivery service and Freshippo stores as distribution points in China, in the U.S. they have partnered with UberEats. While not the same experience, Starbucks is able to take what they’ve learned about optimizing fresh coffee for transport and production in China and apply that to the U.S. delivery experience.

The most important things that international brands can do is to continue to monitor developments and innovations coming out of China, to travel to China to see them for themselves and to adopt the New Retail mindset in developing a comprehensive, transformation strategy.

.jpg)