Reducing their reliance on conventional auto dealerships to drive sales in China, luxury automakersare increasinglytaking to the Internet to reach the country’s affluent and digitally active consumers, according to a new report.

Out of 18 luxury marques surveyed by L2, a U.S. business intelligence firm that tracks the digital performance of consumer brands, 10 have flagship virtual stores on Tmall.com, Alibaba Group’s market-leading B2C website. The L2 report, which included Audi, Mercedes-Benz and Maserati, found that while most of the premium brands allow consumers to book appointments at dealerships online, eight carmakers are selling vehicles directly to buyers through Tmall.

“Tmall is the main e-commerce platform for luxury auto brands in China,” L2 concluded, noting that Maserati joined Tmall in order to reach customers in lower-tier Chinese cities where the company lacks local dealerships.

A 2016 survey by Capgemini Consulting found that Chinese consumers are among the likeliest in the world to buy new cars online—77 percent said they would be willing to do so, “making China an especially crucial market for brands to demonstrate strong digital capabilities,” L2 said.

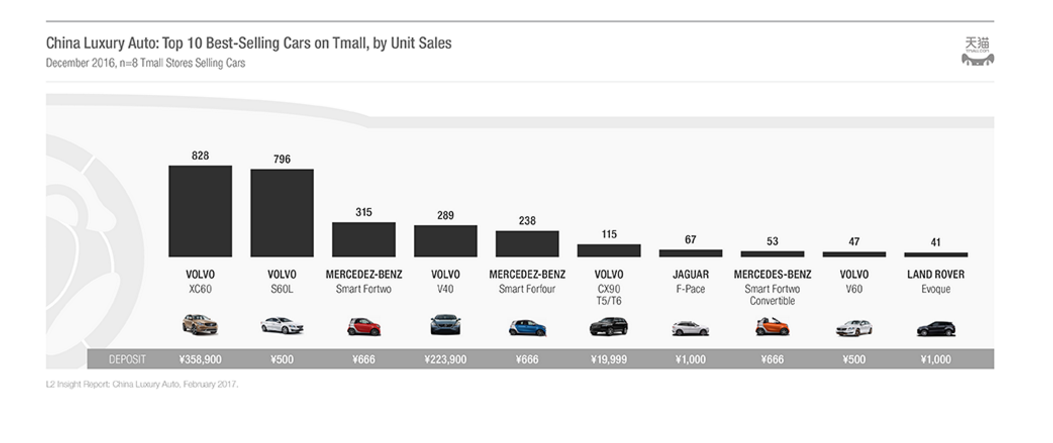

With the exception of Maserati, luxury carmakers currently are using Tmall to sell lower-priced, mass-market models—so-called “accessible” luxury. Mercedes-Benz, for example, only sells its Smart cars on the platform. Of the luxury carmakers surveyed, Volvo, owned by Chinese automaker Geely, is the top marque on Tmall with five out of the top 10 best-selling models, according to L2.

Tmall is China’s largest B2C shopping site with a 56.6 percent share of the $378 billion market. Alibaba Group’s China retail marketplaces, including Tmall and C2C site Taobao, had 443 million annual active buyers in the quarter ended Dec. 31.

While some luxury brands “remain concerned that Tmall may be too mass-market for their brand DNA,” L2 said, “the emphasis on using Tmall for accessible luxury extends beyond the auto sector.” L2 cited the beauty-products category, in which 73 percent of “prestige” brands have Tmall virtual stores.