Alibaba Group is sticking to its long-term vision—and the ambitious numbers that accompany it—Executive Chairman Jack Ma said Friday.

Speaking to investors to close out the group’s 2017 Investor Day summit, Ma said his target is still for Alibaba to hit gross merchandise volume of $1 trillion in the fiscal year that ends March 31, 2020, as well as create 100 million jobs and serve 2 billion customers.

“Five years ago, when the Taobao and Tmall GMV just crossed $170 billion GMV, which is RMB1 trillion, I had a crazy idea, I said,’What if we could make $1 trillion by the 20-year anniversary of Alibaba, the year 2019—today we call it the 2020 fiscal year—we should meet the $1 trillion U.S. dollars?'” Ma said. “But I hate the exchange rate.”

Ma said the Chinese yuan, which was closer to six per dollar at that time is now perched closer to seven per dollar, “so we have a RMB1 trillion gap, which is not easy.”

What happened during Day One of Alibaba’s investors’ summit? Find out here.

Ma was the final speaker on a day that featured a number of top executives providing insights into the company’s performance, strategy and progress across a wide range of owned and affiliated businesses. More information on those sessions is below:

Building Long-Term Value for Alibaba

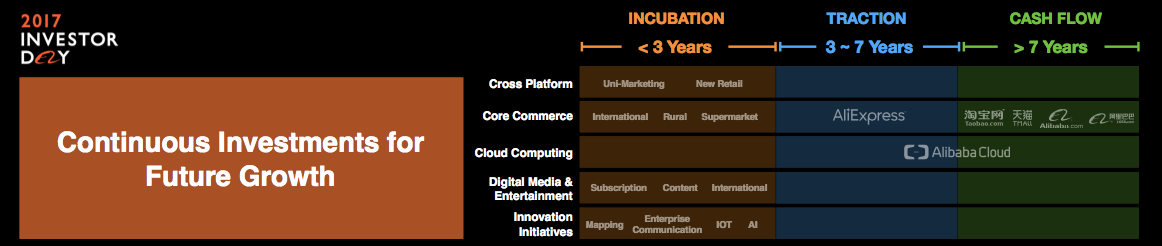

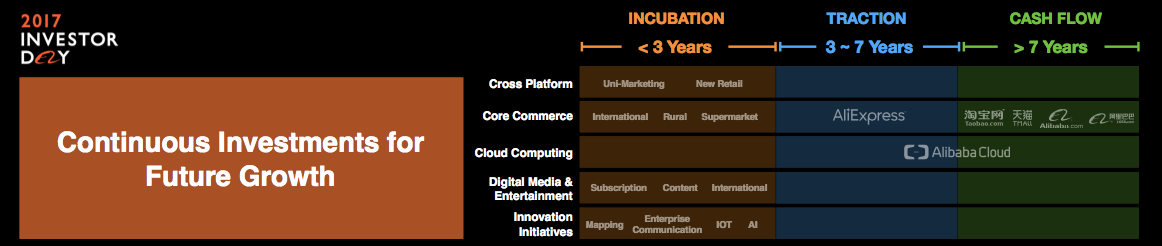

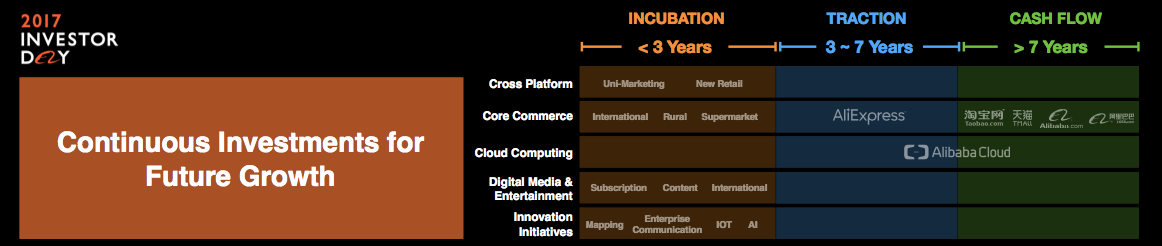

Over the past two years, Alibaba has put $21 billion worth of its capital toward mergers, acquisitions and investments, said Executive Vice Chairman Joe Tsai.

While many critics have questioned the logic behind those moves, claiming they seem disparate and without focus, Tsai said there were, in fact, intentional and specific strategies behind each one.

He noted a common theme among all the executives who spoke during the two-day investor summit: that as wide as Alibaba’s ecosystem of e-commerce, media and entertainment properties seemed to be, there were extensive synergies between them that delivered value to the whole. Alibaba’s investment strategy, then, was to complement and expand those synergies, Tsai said.

“The purpose is to build long-term value for Alibaba,” he said. “Is this asset going to add to the overall value of the business? The only way to add value is to create synergies.”

Tsai said Alibaba watches the latest trends in technology, product development and consumption to see how they might feed into the company’s operations. Potential investment or acquisition targets must fit into four key areas, he said: improving the customer experience, acquiring users and new user profiles, expanding Alibaba’s geographic footprint, or pushing the company further into New Retail. For example, the purchase of video-streaming site Youku added new users to the Alibaba ecosystem, while the acquisition of Southeast Asian e-commerce platform Lazada Group added both new users and new markets in which to operate.

There are, however, times when Alibaba isn’t prepared to purchase a company outright or buy a controlling stake. It may, then, invest a smaller amount at first in order to incentivize a target’s management team to keep their interests aligned with those of the company that Alibaba will eventually purchase, as was the case with UCWeb before it ultimately bought the company in 2014, Tsai said.

Also, there may be obvious strategic value in a target company, but the capital necessary or ability to fully integrate that company may require a phased-in approach. At other times, an investment may operate outside of Alibaba’s core businesses, and therefore a minority stake may help to generate synergies through an equity relationship, said Tsai.

Given these parameters, Alibaba’s investments have been “fairly concentrated,” Tsai said.About 75 percent of the $21 billionhas been put toward key strategic initiatives, including digital media and entertainment, international expansion, logistics and the O2O and local services sectors.

“So all told, our approach is not very scattered,” Tsai said. “Our approach is actually very, very concentrated and very, very focused.”

Everything Old Is New (Retail) Again

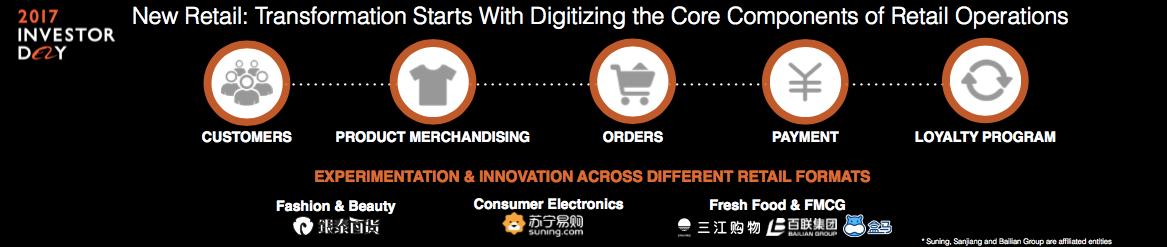

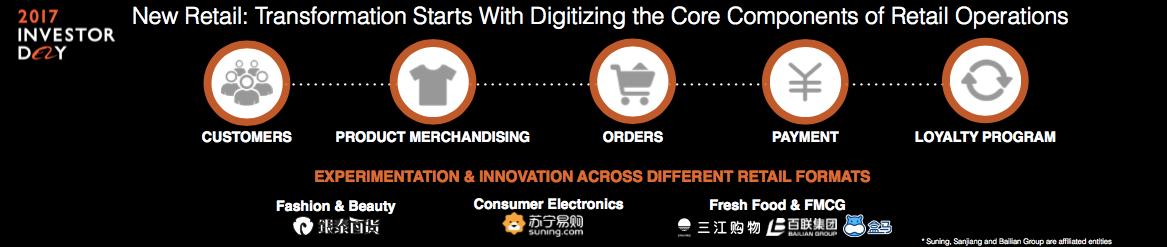

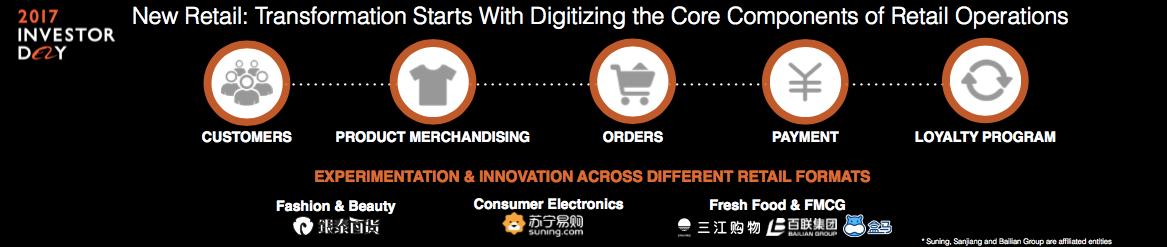

Alibaba has positioned itself as an innovator and enabler of what it calls New Retail, the integration of online and offline commerce and the digitization of core retail operations. The company anticipates that internet technology and big-data analytics will spark nothing less than revolution that will rescue increasingly outmoded brick-and-mortar business models. “New Retail is a new animal in the retail market,” said Alibaba Group CEO Daniel Zhang on the first day of Alibaba’s Investor Day conference.

But like an elephant in a dark room, right now it’s impossible to describe exactly what that animal looks like. “You can’t say, ‘Heres an old department store and here’s a new department store, or here’s an old hypermarket and here’s a new hypermarket,’ ” Zhang said. “I think that’s wrong.”

No one is sure how this technological disruption will unfold—which is why Alibaba has been making investments in traditional merchants like InTime department stores, retailer Bailian Group, supermarket chain Linhua and electronics retailer Suning. The company needs partners willing to experiment and drive innovation.

“We’re not going to end up as a real estate company,” joked Tsai, alluding to the fact that a lot of the value in old-school retailers is in their property holdings. To convince the retail industry to think differently, “we have to develop the right prototypes ourselves that have been proven to work,” Tsai explained. “Once we have those prototypes, I think you will see over time we will be able to show those prototypes (to reluctant retailers) ‚Ķ and it becomes a much more credible conversation.”

The goal is not to take market share from bricks-and-mortar, but to enable those offline stores to use Alibaba technology and Internet marketing and sales to improve their operations, enhance customer relationships and boost sales per square foot. “We see ourselves as a enabler of that 85%, not a competitor,” Tsai said. Alibaba’s large base of more than 500 million mobile users, “is a lot of foot traffic,” he added.

From E-commerce to Entertainment

Yu Yongfu, the head of Alibaba’s Digital Media and Entertainment group, showed how the company is able to maximize the value of content by leveraging Alibaba’s vast ecosystem.

As an example, he pointed to “Once Upon a Time,” a fantasy drama licensed for viewing on Alibaba-owned video-streaming site Youku. Alibaba Pictures has turned the show into a feature-length movie, slated for release next month, while Alibaba’s Tao Piao Piao is handling distribution and ticketing. And merchandise for the move is already being sold on Taobao and Tmall, totaling over RMB 300 million so far.

This merger of e-commerce and entertainment, where the value of content and intellectual property is maximized through advertising and consumer products, is of critical importance to Alibaba’s business model in this space, according to Yu.

“Today, content is very key, but ultimately, the winning strategy has to be beyond content,” he said.

Data plays a central role here as well. Yu noted how Alibaba was able to drive box office sales in China for “A Dog’s Purpose,” a co-production of Alibaba Pictures and Steven Spielberg’s Amblin Entertainment.

Mining its massive trove of consumer data for consumers who previously purchased pet products and those who engaged with related content on Alibaba’s various media platforms, the company was able to deliver specific advertisements for the movie to its most likely audience. The end result: box office sales in China hit $88 million compared to $64 million in the U.S. “This is a good case of how we can leverage our resources and do precise marketing,” Yu said.

AI and Alibaba

Answering a question from the audience on Thursday about Alibaba’s development of artificial intelligence, Tsai noted the company is already using an AI chatbot that can handle 90 percent of customer enquiries and is spreading learning-machine technology to other areas such as logistics and product search.

“A lot of companies say they have an AI department,” Tsai said. “We don’t (say that) because AI lives in every part of our business,” he said, noting that AI “is only in the first inning of the game ‚Ķ We will be able to sprinkle lots of AI surprises into our core businesses to make our core businesses more valuable.”

Clear Skies Ahead for Alibaba Cloud

Investors and analysts attending the second day of Alibaba Group’s Investor Day conference were wondering if Alibaba Cloud, Alibaba’s cloud-computing subsidiary, could maintain its rapid expansion after eight consecutive quarters of triple-digit revenue growth rates.

Alibaba Cloud President Simon Hu assured attendees that, despite competition from players such as Amazon’s market-leading AWS cloud business, there are abundant blue-ocean growth opportunities globally and in China’s nascent market, which is projected to reach $20 billion by 2020, according to Bain & Co.

More than one-third of China’s top 500 companies, among them energy giant Sinopec, automaker Geely, and telecoms company China Unicom, are already Alibaba Cloud customers, as are numerous government agencies like China Customs as well as the 2022 Beijing Olympics—yet the market has barely been tapped.

“This indicates there are strong growth prospects for Alibaba Cloud going forward,” Hu said. With 15 data centers worldwide, “today our footprint is expanding across the globe, in the U.S., Japan, the Middle East and across Asia ‚Ķ we are truly serving a global marketplace” In the quarter ended March 2017, Alibaba Cloud reported it had 874,000 paying customers; Revenue in the quarter was $314 million, an increase of 103% compared with the same quarter of 2016.

Launched eight years ago, Alibaba Cloud is a relative latecomer to the market, but the company is already the world’s fourth-largest Internet cloud services provider in revenue and was No. 1 in China’s public cloud market last year with a market share of more than 40%, according to IDC. About 37 percent of all websites in China are hosted by Alibaba Cloud.

Hu’s positive outlook is based in part on growing demand from Chinese companies in financial services and manufacturing that are ripe for digitalization through cloud computing. China’s vast manufacturing sector wants to transition to smart manufacturing to gain greater supply chain control, yet just 1% of manufacturers have cloud capabilities today, he said.

“That’s going to go up fast,” Hu said. In addition, “many retailers want to be selling offline and online and do omni-channel marketing, this is another big opportunity for us.”

Alibaba Cloud’s innovations in big data analytics and data processing, augmented by artificial intelligence, are also expected to drive growth as the company expands its cloud services and solutions. Businesses don’t just want to store and process data in the cloud because of cost efficiencies, “businesses want to know how to use data,” Hu explained .

“What we can do in terms of technology is provide a deeper level of service. Over the course of the past year, data intelligence has become the most important strategy for Alibaba Cloud ‚Ķ We have 10 years of experience with (AI) algorithms and we are able to leverage that quickly.”

But will Alibaba Cloud, which is nearing profitability, continue to grow triple digits? “We believe cloud will continuously see strong growth in revenue from both more customers and increased customer spending,” said Alibaba Group CFO Maggie Wu.

“We Are A Technology Company”

Alibaba Group Chief Technology Officer Jeff Zhang wants to settle this question once and for all: is Alibaba an e-commerce company or a technology company?

“We are a technology company–we’re built on data,” Zhang said. “What all of our business units want to do with data comes down to us.” In other words, Alibaba’s massive network, data servers and computational horsepower is the fuel that powers the company’s e-commerce, not the other way around.

Not only is Alibaba a tech company, it’s one of the world’s premier tech companies, Zhang said, one that has integrated into its businesses advanced image-recognition and voice-recognition technology, artificial intelligence and “the world’s fastest cloud processing, or streaming processing, platform.”

“Our businesses are more diverse and complex than any other internet company,” he said, pointing out that Alibaba is able to drawing extensive data on shopping habits, geo-location apps, financial services and scores of other sources to help better serve customers and drive efficient merchant operations.

To cite just one example, the result of this capability can be seen in the Mobile Taobao app, which displays personalized homepages that are unique in both layout and content for millions of individual users, adding shopping recommendations from a pool of more than one billion products.

This is a bigger challenge than faced by other major internet companies, Zhang said.”Amazon and eBay are probably the biggest customers of Facebook,” he explained.”On Facebook, you see Amazon advertising and the advertising you see is different for everybody, but thereare only 100,000 products listed so they are selecting one from 100,000 products to recommend to you. So, we have a billion products; one relevant product in a billion to recommend to you requires a higher level of technology.”

While a lot of companies are investing in artificial intelligence, Alibaba has all the ingredients necessary to develop practical AI solutions and is hard at work rolling them out.

The company has massive amounts of data as fodder for learning machines, robust computational power to support real-time AI applications and process complex problems efficiently, advanced AI algorithms, and, perhaps most important, a business that is rich in opportunities to apply AI in ways that are practical and useful.

“Only if you have these things can you truly say you are an AI company,” Zhang said. “So yes, we are better at AI than other companies,” adding that “we are continuously training our systems so our platforms are becoming increasingly intelligent, and that’s our advantage.”

“At Alibaba, we are literally launching new products and new solutions each and every day,” Zhang said. Without giving details, he added that the company is investing heavily in speech-recognition technology and this summer will unveil “a whole new series” of products based on a voice-controlled intelligent platform, products for the home, entertainment, hospitality industry and education markets.