China’s cross-border e-commerce market is expected to continue to grow at double-digit rates, according to research firm Mintel, boosted by favorable government policies and an increasing Chinese propensity for overseas travel that is increasing their desire for foreign goods.

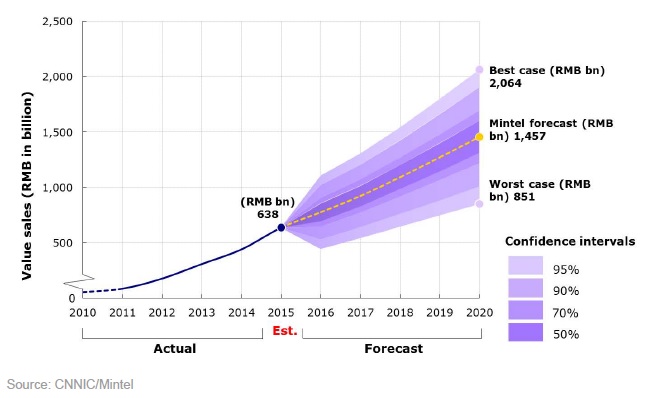

In a new report, Mintel projected that cross-border e-commerce will have a compound annual growth rate of 18 percent through the end of the decade, reaching an estimated $222.3 billion from $97.3 billion last year. That will represent 17 percent of the $1.3 trillion in total online retail sales in China expected in 2020. The cross-border online shopping market grew at a CAGR of 63.3% from 2010 to 2015, according to Mintel.

Total Historical and Forecast China Cross-Border Online Retail Sales, 2010-20

A number of factors are driving growth, Mintel’s director of research in Asia Pacific, Matthew Crabbe, said in the “Haitao Shopping” report. Haitao loosely means “to purchase products overseas” in Chinese.

“As more consumers go online and travel overseas, more will become interested in buying foreign products online,” Crabbe said. A Mintel consumer survey found travel has a direct influence on people’s openness to foreign goods, “as 27 percent of surveyed consumers said their choices of overseas online shopping websites is influenced by where they had traveled overseas,” the report said.

Cross-border shopping is also getting an assist from government policies promoting online sales, as well as the surging use of smartphones for online shopping and the spread of online payment systems, according to Mintel.

Mintel’s consumer survey revealed that Haitao shoppers tend to associate countries with certain favored products. For example, they like to buy beauty and personal care products from South Korea and food and drinks from Taiwan. They look to Japan for beauty products and personal electronics, while New Zealand is preferred for baby food and baby products.

One the most significant findings from Mintel’s consumer survey is that food is a much more significant online shopping category from overseas websites than from domestic websites.

“This is creating a market opening for food companies to target Chinese consumers directly,” the report said. “It is also helping many foreign modern grocery chains to enter the China market online, from outside the country, without initially having to set up local physical stores.”