As the impact from Covid-19 wanes in China and new consumer trends take shape, beauty brands have continued to discover untapped opportunities and pick up growth on Alibaba Group’s B2C online marketplace, Tmall.

The e-commerce platform has reached its beauty sales target a year ahead of schedule – doubling that of 2019 – it announced at an industry event on Wednesday. This comes as the nation’s consumers have increasingly shifted to shopping online and at home especially due to travel restrictions, while brands from around the globe are looking to meet them where they’re at.

More than 3,000 beauty merchants launched new stores on the platform last year, per Tmall. During the same period, 603 beauty and fast-moving consumer goods brands achieved RMB100 million ($15.32 million) in sales, while 42 labels reached RMB1 billion and three brands hit the RMB5 billion milestone.

Out of the crisis emerged new opportunities, said Jason Chen, general manager of Tmall’s fast-moving consumer goods division. Pandemic disruptions have stunted growth in some beauty categories like lipsticks, but others, such as wellness-driven beauty products, have entered the mainstream.

“Each emerging category represents an unfulfilled consumer demand,” he said. “That’s why we have spared no effort to develop these new categories on the platform and that has, by a large degree, helped us mitigate the pandemic’s impact and fuel growth for the industry.”

Business Growth in the New Normal

Sales of facial cleansers and home-use beauty devices have boomed, Tmall said. Notably, male cosmetics have been in high demand amid shifting ideas about gender roles: men’s primers grew by 50%, foundation by 100% and eyelash-related products by 200%.

It also saw the rise of influencer beauty brands and consumer-to-manufacturer players, companies with responsive supply chains that can make products based on real-time consumer feedback and rapidly bring them to market.

Agile supply chains make this possible. Chen recalled that a supplier – whose factory, just five years ago, set 30,000-50,000 bottles as a minimum order requirement. Now, it can turn around orders of just 300-500 bottles. With an increasing appetite for personalized products in China, at ever-faster speeds, the supplier carved out a dedicated, nimble team to serve clients who want to produce smaller orders as a low-risk way to trial their innovations in the market.

Tmall shares trends and insights such as these with beauty brands, pointing them towards the potential growth categories, marketing tools and consumer segments where they’d have a distinct advantage.

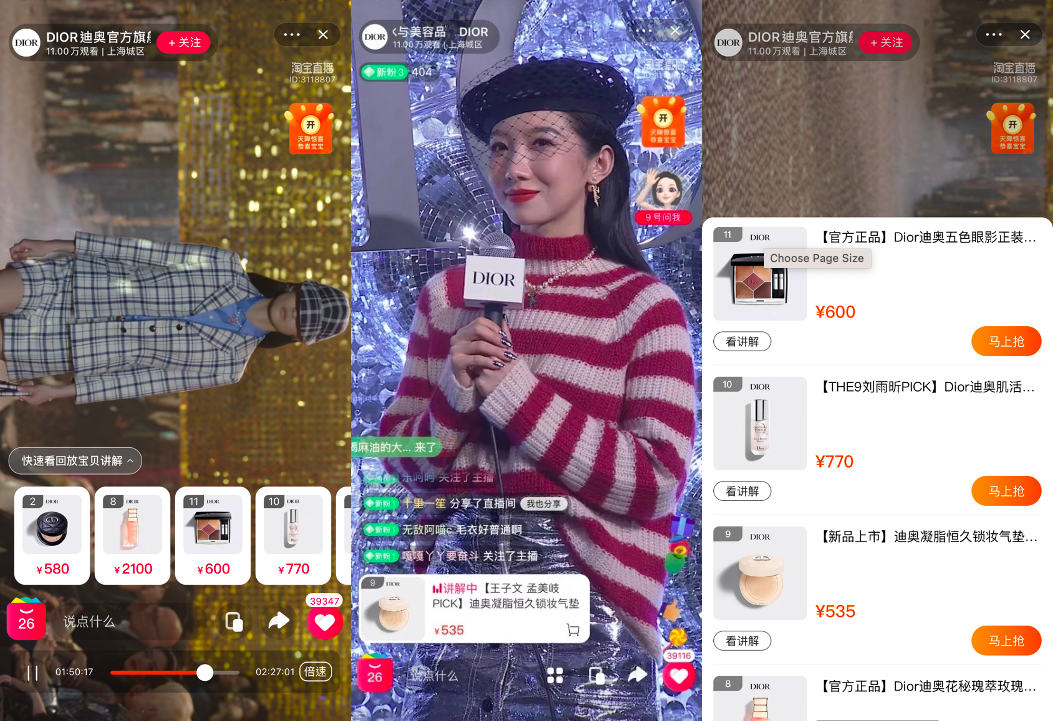

Prestige beauty brands, for example, can make use of Tmall’s tailored solutions to connect with the estimated 70 million high-end beauty mavens on the site. Earlier this month, Dior use livestreaming technologies to broadcast the fashion house’s pre-fall 2021 fashion show, allowing Chinese consumers to “see now, buy now” and purchase some of the cosmetic products used in the runway looks.

Other luxury cosmetic and fragrance labels, including La Mer, have curated small-scale, private livestream programs to engage VIP customers. To offer shoppers a personal touch, Giorgio Armani and Hermès have also offered bespoke engraving services via their Tmall flagship stores.

Shaping the Future of Beauty

“We used to discuss supply only in terms of products,” Chen said. “But today, the concept of supply also extends to content and services. Successful brands of the future won’t just have a powerful supply chain to manufacture and deliver products, but for generating content and services, he added.

“All three parts have to work around the clock so the brand can continue building new experiences, content and connections with consumers.”

Amid uncertain and fast-changing times, what doesn’t change is the need to put consumers at the center and continue building long-term customer relationships, said Candy Deng, vice president of e-business and media operations at P&G Greater China.

Deng said it’s no longer enough for brands to look at their e-commerce operations as only a source of traffic. P&G sees Tmall as an important content hub, which it uses to connect with and bring personalized promotions to tens of thousands of customers. “In uncertain times, the only certainty is to build a brand that customers like.”

Moving Forward

Tmall plans to step up its full-chain solutions for beauty brands this year, including lowering the barriers to registering a store on the platform – such as easing its restrictions for capital requirements and how long the seller has been in business – and improving the searchability of brands’ products, strengthening their chances of product-launch success and helping them innovate new products and expand to new categories.

Starting from the 6.18 shopping festival, it will boost the visibility of brand-produced livestreams. Another focus this year will be launching new and exciting technologies that will take the shopping experience to the next level. This includes plans to launch a new artificial intelligence-powered oral-health testing feature, developed with Alibaba’s research arm DAMO Academy, which will deliver personalized results and recommended products to consumers.

The research of DAMO scientists powers some of the most cutting-edge experiences across Alibaba’s ecosystem, from self-driving logistics cars to the AI-enabled virtual livestream hosts, featured during last year’s 11.11 Global Shopping Festival.

The next decade will also mark a new “golden age” for new brands, said Chen. Over the next three years, the platform plans to help incubate 200 emerging brands capable of generating over RMB100 million in sales and support more than 10,000 new and emerging brands to become leaders in their respective, niche categories.

“We want to provide the fuel and soil that helps brands grow.”

Sign up for our newsletter to receive the latest Alibaba updates in your inbox every week.