Alibaba Group has piloted Luxury Soho, a new platform aimed at young, value-conscious luxury shoppers. We spoke to Christina Fontana, head of Tmall Fashion and Luxury in Europe, on the launch of the new platform and why she sees it as the company’s next major destination for premium brands after Tmall Luxury Pavilion.

What is Luxury Soho?

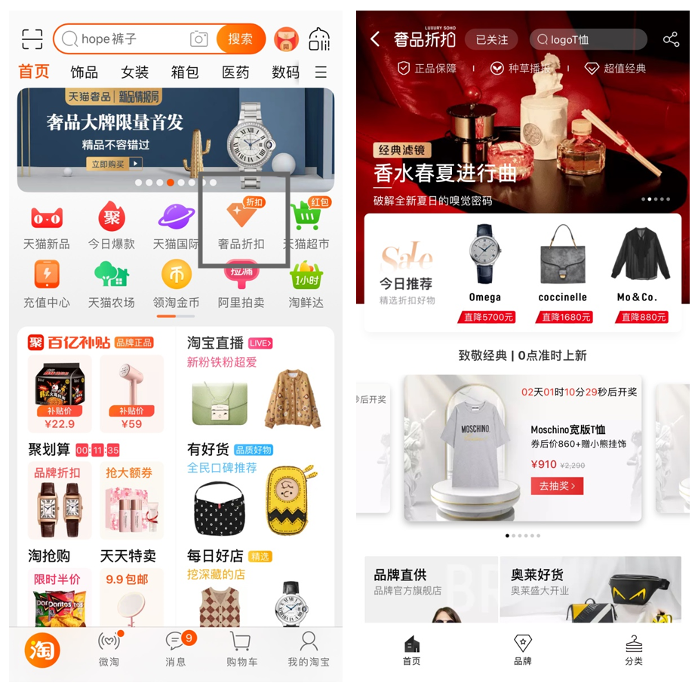

We named Luxury Soho after New York’s fashionable Soho district. The new platform can be accessed via Mobile Taobao and brands’ flagship stores. We see it, first and foremost, as a solution to help luxury brands attract younger consumers as well as those who may even be new to luxury. We envision it as a new gathering space for young people, where they can discover new designer brands and experiences and, potentially, where they make their first luxury purchase.

It’s also a response to the need in the fashion industry for brands to be able to efficiently manage their inventory and stock – an issue that’s been compounded by the Covid-19 outbreak. Restricted movements led to reduced foot traffic in brick-and-mortar stores – including from Chinese tourists who were not able to travel to brands’ boutiques and outlets in Western countries like they used to.

So brands are now sitting on a worldwide abundance of stock and are also needing to find ways to reach new consumers. With Luxury Soho, brands can now move select products and collections onto an online outlet store and bring them in front of a specific audience that is waiting to discover new products and brands.

How is Luxury Soho positioned differently from Tmall Luxury Pavilion?

Think a flagship store at a high-end shopping district downtown versus a designer outlet in the outskirts of the city. The Pavilion is the former, where consumers can find the hottest new collections and services, while Soho stores are home to luxury deals, older collections, timeless classics and vintage collectibles. The two types of stores are physically distanced – often an hour’s drive apart from each other – and this separation is something that can be kept in the online environment.

We designed Tmall Luxury Pavilion to serve almost as a second website for brands in China. Luxury Pavilion stores bring the exclusive experience of shopping in a brick-and-mortar environment online. It is more focused on branding and aimed at a more affluent class of consumers. Luxury Soho, on the other hand, targets younger, newer luxury consumers, such as those from China’s lower-tier cities or Gen Z shoppers who are just entering the world of luxury.

The majority of luxury consumers on Tmall were born after 1985, but we are now seeing rapid growth from younger generations born after 1995. This rising demographic is digitally savvy and more interested in buying goods online. They are price-conscious and prefer products with good value but also appreciate quality craftsmanship and premium experiences. These are the kind of consumers we want to help brands on Luxury Soho build a deeper connection with.

Is a store on Luxury Soho the digital equivalent of an outlet?

Luxury Soho is much more than an outlet. Luxury Soho is a full-chain solution that helps brands effectively manage their inventories. The platform provides brands with an opportunity to uncover new consumer insights and improve their engagement with different consumer segments across the product life cycle.

Luxury Soho also plays into brands’ existing outlet strategies. It can empower them to diversify their strategies in China to handle excessive inventories with more flexibility. As a platform, we offer the tools for brands to run their own stores with full control over their pricing, product selection, strategy and look and feel. They can engage consumers in new ways using innovative features, from livestreaming, augmented reality and 3D interactive technologies to virtual icons and flexible payment solutions. Brands can even tap their offline store associates to engage with consumers online to showcase certain products and answer questions.

What types of brands are you looking to bring on?

There are different ways a brand can choose to activate their presence on Luxury Soho. Brands such as Coach which have a large variety of products tailored to the Soho consumer can open a full-fledged outlet store on the platform. But for some other brands, it can be difficult to have enough merchandise to fill their Pavilion flagship in addition to creating a differentiated outlet presence.

Brands like Moschino might choose to open a “lite store,” which offers special exposure for smaller quantities of products. On April 25, with just three weeks of preparation, Moschino sold out all of their stock in its pilot campaign on Luxury Soho.

What is your outlook for the luxury sector?

The future for luxury could look very different. There will be more flexibility in how people shop for luxury items and how brands handle off-season or excess products. We’ll see more sustainable alternatives emerge as well as more brands being open to new and innovative ways of managing stock across product life cycles, like through Luxury Soho.

In the past, luxury brands might have operated multiple stores across China to be able to reach more consumers. But the coronavirus outbreak has exposed some underlying vulnerabilities in this model and accelerated changes in consumer behavior, including the shift from shopping in-store to shopping at home. To build resilience and meet consumers where they are at, more luxury brands will think about how to move their in-store experiences online.

Luxury travel retail was also hard hit by the crisis. Both leisure and business travel are expected to decline significantly over the next two years, directly impacting the overseas markets and travel retail stores that traditionally relied on consumption from Chinese tourists. Affected brands need to consider how to turn their focus towards China’s domestic market and explore new ways to market to consumers there.

Sign up for our newsletter to receive the latest Alibaba updates in your inbox every week.